Budgeting is a job that many of us dread, whether you’re halfway through the year and trying to get your finances under control or about to end your financial year.

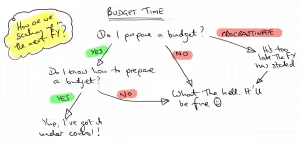

For some (not all) this causes many owners and practice managers to break out into a cold sweat and descend into a decision tree something like this 😀. Look familiar?

To help you avoid that "groundhog day" feeling and to encourage you to embrace budgeting and prudent financial management this article will:

- Explain why you need a budget

- Explain what management accounts are in non-accounting terms

- Provide you with a FREE and totally proven template that will streamline your budgeting process and your management accounts

- Explain (in detail) how to use the template so that you can create a budget and maintain a professional set of monthly management accounts.

[maxbutton id="5" ]

Many practice managers/owners tend to view budgeting and maintaining management accounts as a "nice to have". One of those things that you do perhaps when you start out your practice but never repeat.

Not so. If you don't have a budget and a simple set of management accounts you're probably not managing your business effectively and may be doing a dis-service to everyone that relies upon you - family, employees, clients, suppliers etc.

Bottom Line: Your budget in conjunction with your management accounts give you direction, control and peace of mind. Without them you have little or no ability to make informed decisions and/or change the direction of your business, should you need to do so.

By having a budget and a simple set of management accounts you:

- Will have clear understanding of what your year-end result is likely to be

- Will be able to make informed decisions about hiring staff and reducing headcount, should that be required

- Will be able to make informed decisions about investment or rental of new equipment/premises etc

- Will have a mechanism that you can use to perform a simple monthly review to ensure your practice is on track

- Will have a measure of success - everyone loves good news and knowing that you've blown your budget can be highly motivating for the whole team, particularly if you're transparent about these things - we are, here at WriteUpp!

- Will have a measure of failure - in my experience the single biggest reason established businesses go under is they fail to identify the warning signs soon enough and don't take remedial action (cost-cutting) quick enough. If you genuinely have ambitions of running a business with longevity there will challenges, you will need to make cuts and you'll come back from them but only if you can act quickly and decisively

- Will have a a fighting chance of raising finance and/or debt to fund your business. Without demonstrable budget and decent management accounts you won't stand a chance!

- Will be much better positioned if you choose to sell your business at some point in the future. Most acquirers don't want to spend months trawling through your books to verify your historic performance so being able to present your management accounts for each year clearly and coherently will put you in a stronger position.

What are management accounts?

Many of you will be familiar with the Statutory Accounts that you file with Companies House every year. These are typically prepared by your accountant or your Finance Director and they represent a VERY high-level, retrospective summary of your financial performance. They tend to contain little or no useful information and in reality only tend to get used to:

- Satisfy your legal/statutory requirements

- Calculate your Corporation Tax (CT) liability

Once they've been lodged with Companies House and you've filed your CT600 they will be filed away and they never see the light of day.

Management Accounts are an altogether different beast. If you've never produced them before my advice would be to keep them simple (our downloadable template below will help with this!). But rest assured you don't need to be a chartered accountant to create them, maintain them or use them to manage your business.

If you're short of time you can get your accountant to produce them for you (at minimal cost) but in reality all you really need to do is make sure that your Management Accounts template (see below) mirrors the same revenue, cost of sales and overhead lines as the Monthly P&L report that your accounting system generates.

How do you streamline budgeting?

Here at WriteUpp our financial year begins April 1st so we typically begin our budgeting nice and early at the end of February/beginning March. This culminates in an annual budget and a new set of management accounts a few weeks before the start of the new financial year.

The template that we use is the same tried and tested format that we've been using for the last 7 years since we started WriteUpp! It's also the same template that I used when I was the CEO of a multi million pound publicly quoted business. Whatever size your practice is, I promise it will work. Sure, you might need to make some tweaks but the core template is rock solid.

[maxbutton id="5" ]

Setting up the template for your practice

The template is produced in Google Sheets but can exported to Excel if you'd prefer. You'll notice that it contains some sample data. This is just there to bring the template to life and should be replaced with your own data. The steps below explain how to customise the template to suit your own practice and how to enter your data.

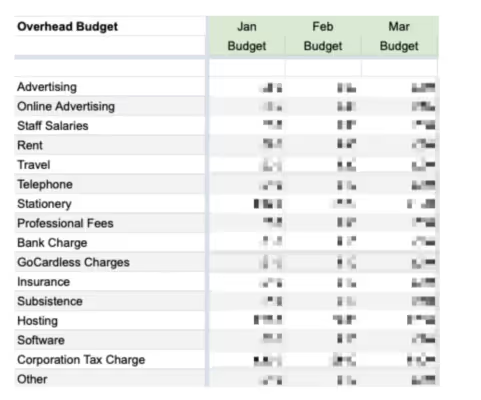

- This is not critical but before you get started try to make sure that the Sales and Expense line items in the Actual vs Budget, P&L Budget, Sales Budget and Expenses Budget tabs are the same as the sales lines and expense lines in your preferred accounting system. The easiest way to do this is to generate a monthly P&L report in your accounting system. Below is an example of the Expenses part of this report:

- NOTE: The line items in the screenshots above above differ slightly from the template as they've been taken directly from our accounting system (Kashflow) and from the management accounts pack that we use on a day to day basis.

Once you've gone through this process for the Expense line items you should also go through the same process for your Sales line items

TOP TIP: This is also a good opportunity to make sure that your accounting system is capturing your sales and costs in line with your business needs. For example, you might want to split Sales between Treatment Sales and Consumable Sales so that you can track their growth individually. - The benefit of doing Point 2 will become clear when you start to use the template on a monthly basis, covered in the next section.

- Click on the Expenses Budget tab, go to cell B1 (yellow) and enter the first month of your financial year. For example, if it's the 1st April enter Apr-20 (mmm-yy). Like magic all of the other months will automatically update in this tab and all of the others!

- Stay in the Expenses Budget tab and enter your budget expenses for each month and for each line item. What we tend to do to speed this process up is look at the previous year's expenditure for a line item (say Rent), calculate the average monthly cost for that line item, apply an uplift of say 5% for inflation (assuming there are no material changes to your practice) and then copy that across each month. In some cases, you might need to phase the costs. For example, if you pay utilities quarterly.

- Switch to the Salary Budget and starting in cell N3 (yellow) enter the pre tax salary for each of your clinicians/team members. When you do this you will see that the monthly cost for each clinician is automatically calculated (before NI & PAYE). All staff salaries are then totalled up in row 16 where a simple multiplier is applied to roughly account for NI & PAYE. We always apply a 10% uplift but if you would prefer something higher/lower you can adjust this in cell C23 (orange)

- As a practice owner if you don't pay yourself a salary but instead payout dividends (more tax efficient!) you can enter your expected annual dividend in cell N14 (yellow) of the Salary Budget tab and this will automatically calculate your quarterly dividend payments/costs. These are summed up each month in a separate line item (row 17) so that you can distinguish between staff costs and directors/owners remuneration. No NI or PAYE is applicable to these payments if they are dividends.

- In the Sales Budget tab we'd encourage you to give some thought to your sales by line item and by month, taking into account seasonality, historic trends, school holidays etc. If you wanted to speed up the process you could just apply your expected annual sales linearly across each month but doing this might give you a false impression of your monthly profitability and may result in you failing to identify possible cash crunches.

- Having completed the Expenses/Sales/Salary tabs if you switch to the P&L Budget tab you will now (magically) see your annual P&L budget 😀

- Obviously what you do with the template is completely up to you but we'd encourage you to:

- NOT enter budgets directly into the P&L Budget tab otherwise you'll screw up the linkages to the individual budget tabs

- NOT adjust your budget as you go through the year. This is meant to be your guide as you advance through the year based on your aspirations and intentions at the start of the year. As such, it makes sense to "freeze" it unless something radical happens that requires you to recast your budget.

- The final (and arguably most important) part of the template is the Actual v Budget tab which is where your actual performance is combined and compared with your budget. The following section explains how you use this tab.

How do you complete the "Actual vs Budget" tab as you advance through the financial year?

The task of keeping your management accounts up-to-date should take no more than 30 minutes per month along with perhaps a further 30 minutes to review them in your monthly management review - this is what we do!

When you prepare them is up to you but we typically do them 2/3 weeks after the month-end. This gives our accountant ample time to prepare our accounts in Kashflow.

Below are the monthly tasks that you need to undertake:

- Run the P&L report in your preferred accounting system. If you followed our advice in Point 2 above your report will contain exactly the same line items as your template.

- Export your P&L report to Excel/Google Sheets and open the spreadsheet. If you've got two screens you might want to open the P&L Report on one screen and the Actual vs Budget tab of the template on another screen

- Go to the Actual vs Budget tab and enter your actual sales, salary and overheads from the P&L report for the month you're reporting on. We've completed this step in the template and made the text bold to indicate that they are actual NOT budget numbers. Additionally, you should change the label in Row 2 from "Budget" to "Actual".

- In the the "Current Month" section (orange) on the right-hand side of the Actual vs Budget tab you need to ensure that the the "Actual" column is linked to the correct month. To do this, click on each line item in Column N and make sure that it is linked to the corresponding line item in the month that you are reporting on. For example, if you're reporting on Jan-20 cell N4 should contain the formula "=B4", cell N5 should contain the formula "=B5" and so on. If you've done this correctly Column N should contain exactly the same numbers as the month you're reporting on, which in this case is Column B.

- You need to go through the same process for the "Budget" column (in the Current Month section) but this time you need to link each line item in Column O to the corresponding line item in your budget. To do this, click on cell O4 and make sure the formula is "='P&L Budget'!B4" and then go to cell O5 and make sure the formula is "='P&L Budget'!B5" and so on. If you've done this correctly all the numbers in Column O will be exactly the same as your budget numbers (in the P&L Budget tab) for the month that you are reporting on. As a result you will be able to see your Actuals alongside your Budget with variances automatically calculated in Column P

- No monthly tweaks are required in the "Expected Out-Turn" section (purple) which combines your Year-To-Date (YTD) Actual + Budget with your Annual Budget (as defined in the P&L Budget tab). This will give you have a clear idea about where you are likely to end up at year-end.

Using your budget and management accounts

Once you've updated your management accounts the review process should take no more than 30 minutes and should focus on the Actual vs. Budget tab. Below is a checklist of tasks that you should probably undertake when you conduct your review:

- Identify any sales variances and dig into why they've happened. Often they're things outside of your control like timing but they need to be investigated so that remedial action can be taken, if necessary.

- Identify any cost variances > 10% and highlight them in yellow - why? Just so you can easily identify them both in the current month and across the year. We highlight them on the Actual vs. Budget tab as and when we enter "Actual" numbers each month.

- Where there are cost variances revert back to your accounting system and dig into the constituent costs that have resulted in you going over budget. Just like sales variations you should take remedial action, where appropriate.

- Review the monthly profit/loss versus budget and assess the possible cashflow impact if profitability is down.

- Review the annual out-turn for each sub-total ( Sales, Cost of Sales and Expenses) and make sure they are broadly on track. At the start of the year this is obviously less meaningful as the out-turn is biased towards your budget and not actual numbers but by mid year you should be looking to see if you're broadly on track.

- Throughout the year keep an eye on your profitability and your associated CT (Corporation Tax) liability so that you provision enough cash to pay your CT when it is due, typically Jan 31st following the previous tax year end.

Join over 50,000 clinicians that we've helped using WriteUpp

Start my free trial